描述

This plugin is only applicable to VAT registered businesses based in the UK that make sales to businesses (B2B) in other EU member states

Each quarter, or even month, UK businesses must submit to the UK tax authority (HMRC) an EC Sales List to document sales made to businesses in other EU member states. This plug-in integrates with Easy Digital Downloads and/or Woo Commerce so it is able retrieve relevant sales records from which to create the quarterly (or monthly) return.

Note: This plugin is free to download and you will be able to use it to create and test EC Sales List submissions. To submit returns directly to HMRC you will need to purchase a credit from our web site: £5 for a single submission; £18 for 4 (quarterly) submissions; £50 for 12 (monthly) submissions.

产品特点

Select your e-commerce package

- Easy Digital Downloads or

- Woo Commerce

Create quarterly or monthly submissions

- Select the transactions to include

- The plugin will only present sales to EU businesses outside the UK so you cannot select invalid sales records

- Specify the quarter for the submission

- Test your EC Sales List return submission before sending it live

Roles

- Provides roles you can use to control who is able to create and submit returns

- Give your accountant limited access to be able to submit returns

- Or only give your accountant the ability to view returns.

Videos

Watch videos showing how to setup the plugin, create a submission and send the return to HMRC

Submit EC Sales list returns directly to HMRC

Buy credits to submit your EC Sales List return directly to HMRC.

屏幕截图

The first task is to define the settings that are common to all submissions.

The second task is to select the e-commerce package you are using.

The main screen shows a list of the existing submissions.

New definitions are created by specifying the correct header information, most of which is taken from the settings, and also select the sales transactions that should be includedin the submission

Any transaction may comprise products which are goods or a service and these transaction types must be reflected in the EC Sales List return. The plugin adds a meta box to the download (EDD) or product (Woo Commerce) so the indicator can be defined.

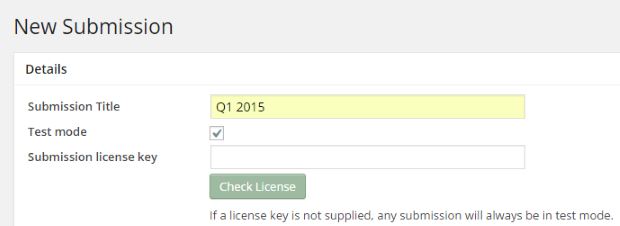

A credit can be purchased to perform the submission to HMRC. The credit license key can be tested for validity. The submission can be tried in test mode before a live submission is attempted and a credit consumed.

安装

Install the plugin in the normal way then select the settings option from the ECSL menu added to the main WordPress menu. Detailed configuration and use instructions can be found on our web site.

Requires

This plugin requires that you capture VAT information in a supported format such as the format created by the Lyquidity VAT plugin for EDD

or the Woo Commerce EU VAT Compliance plugin “Premium version” or

or the WooCommerce EU VAT Assistant.

常见问题

- Installation Instructions

-

Install the plugin in the normal way then select the settings option from the ECSL menu added to the main WordPress menu. Detailed configuration and use instructions can be found on our web site.

Requires

This plugin requires that you capture VAT information in a supported format such as the format created by the Lyquidity VAT plugin for EDD

or the Woo Commerce EU VAT Compliance plugin “Premium version” or

or the WooCommerce EU VAT Assistant. - Q. Do I need to buy credits to use the plugin?

-

A. You are able to create a submission that will list the transactions to be included in a monthly or quarterly return without buying credits. However to send a return directly to HMRC you will need to buy a credit.

- Q. Do I need to buy a credit to test a submission?

-

A. No, you are able to test sending an EC Sales List return before you buy a credit.

评价

此插件暂无评价。

贡献者及开发者

更新日志

1.0

Initial version released

1.0.3

Added currency translation to convert a UK site denominated in, say, USD to GBP.

Added tests to make sure plugin files cannot be executed independently.

Added additional checks to prevent actions being repeated if subsequent attempts would be invalid.

= 1.0.4

Added export

= 1.0.5

Small change to prevent js and css files being added to the front end

= 1.0.6

Changes to address problems with translatability

= 1.0.7

Added support for EU VAT Assistant for WooCommerce from Aelia

Added notices that VAT plugins must be installed and activated

1.0.8

Fixed the tests to confirm the existence of the Lyquidity plugin (EDD) or the Simba or EU VAT Assistant plugin (WooCommerce)

1.0.9

Fixed a problem with the EDD integration which was missing a date element.

1.0.10

Updated references to the service site

1.0.11

Updated add_query_arg calls to escape them as recommended by the WordPress advisory

1.0.12

Fixed text domain errors

1.0.13

Added note alongside the postcode to warn users the postcode must not contain a space. KT35EE is OK.

KT3 5EE will cause an HMRC sumbission validaton failure.

1.0.14

Fixed incompatibility with WP 4.4 that prevented the summary being displayed

Updates to prevent notice messages appear in the WP log when using PHP 7.0

1.0.15

Change the use of home_url( ‘/’ ) to home_url( ‘/’, $scheme = relative ) so the plugin will work on a site using HTTPS

where the site blog table contains HTTP.

1.0.16

It is possible for a VAT number recorded by EDD or WooCommerce to include lower letters. They should always be upper case.

1.0.17

Update WordPress supported version

1.0.18

Update WordPress supported version and changes the user agent on the WordPress remote request to get rates from the ECB because the ECB reject the default user agent string.